This article was published on: 07/11/24

The tapering of the Personal Allowance means some higher-rate taxpayers effectively pay an Income Tax rate of 60%, sometimes without realising. Fortunately, if you’re affected, there could be ways to reduce your tax bill.

A report in the Telegraph suggests 1.35 million workers were affected by the 60% tax trap in 2023/24. Collectively, they paid an extra £4.7 billion to the Treasury. Read on to find out if you could unwittingly be paying a higher rate of Income Tax than you expect.

The tax trap affects those earning more than £100,000

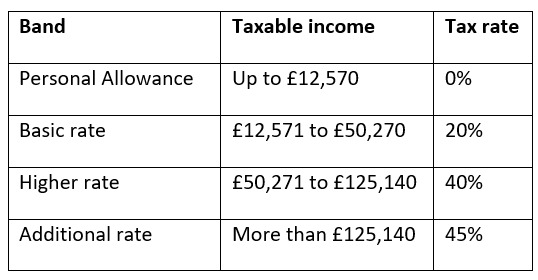

You might think the highest rate of Income Tax is 45%, and officially you’d be correct. Most people pay the standard rates of Income Tax. In 2024/25, Income Tax rates and bands are:

Please note, that different Income Tax bands and rates apply in Scotland.

However, the Personal Allowance is reduced by £1 for every £2 you earn over £100,000. If you earn more than £125,140, you don’t have a Personal Allowance and pay tax on all your income.

For example, if you earn £101,000, on the £1,000 above the threshold, you’d pay £400 of Income Tax at the higher rate. In addition, you’d lose £500 of your Personal Allowance, so this portion of your income would also be subject to Income Tax at 40%, adding up to £200.

So, out of the £1,000 you’ve earned above the tapered Personal Allowance threshold, you’d only take home £400 – a 60% effective tax rate. It’s led to the tapering being dubbed a “stealth tax” in the media.

Further compounding the issue is the fact that the Personal Allowance and Income Tax bands are frozen until 2028.

While the thresholds are frozen, many people are likely to receive wage increases. As a result, more people are expected to be caught in the 60% tax trap in the coming years.

Don’t forget your salary might not be your only income that’s considered when calculating your Income Tax bill. For example, you could be liable for interest earned on savings that aren’t held in a tax-efficient wrapper.

Contact us if you’re unsure which of your assets could be liable for Income Tax.

3 legal ways to avoid falling into the 60% tax trap

If you’re affected by the tapered Personal Allowance, thinking about how you structure your earnings may provide an opportunity to reduce how much you’re giving to the taxman. Here are three excellent options you might want to consider.

1. Boost your pension contributions

One of the simplest ways to avoid paying 60% tax if you could be affected is to increase your pension contributions.

Your taxable income is calculated after pension contributions have been deducted. As a result, boosting pension contributions could be used to reduce your adjusted net income so you retain the full Personal Allowance or reduce the proportion you lose.

Increasing pension contributions could help you secure a more comfortable retirement too. However, keep in mind that you cannot usually access your pension savings until you’re 55 (rising to 57 in 2028).

2. Use a salary sacrifice scheme

If your workplace has a salary sacrifice scheme, it could also provide a useful way to reduce your overall tax liability.

Salary sacrifice enables you to exchange a part of your salary for non-cash benefits from your employer. This could include higher pension contributions, childcare vouchers, or the ability to lease a car.

By essentially giving up part of your income, you might be able to bring your taxable income below the threshold for the tapered Personal Allowance.

You should note that salary sacrifice options vary between employers, so it may be worthwhile to check your employee handbook to see if any options could suit you.

3. Make charitable donations from your income

If you’d like to reduce your Income Tax bill and support good causes, you could make a charitable donation. Again, by deducting donations from your salary before tax is calculated, you could manage how much of the Personal Allowance you lose.

Contact us to talk about how to manage your tax bill effectively

There may be other steps you could take to reduce your overall tax bill. A tailored financial plan will consider your tax liabilities, including from other sources, such as your savings and investments, to highlight potential ways to cut the amount you pay to the taxman.

If you’d like to arrange a meeting, please get in touch.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.